CES

Aviation

January 11, 2023

How Delta Is Building Its New CX Experience Platform

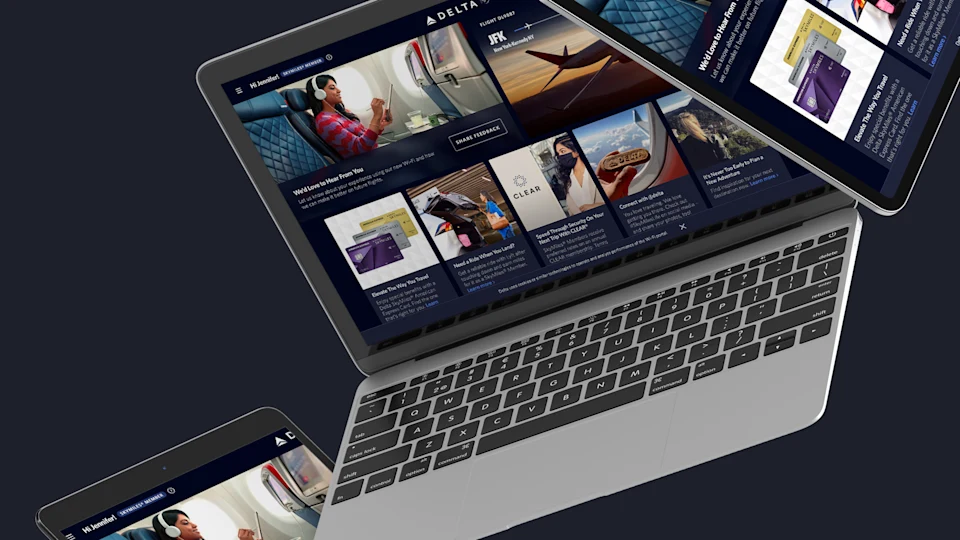

As part of its free Wi-Fi announcement this month, Delta will also roll out a completely new seatback interface designed to mimic a smart TV experience.

Words by Jennifer Leigh Parker

Did the CEO of Delta Air Lines just call seatback screens “dumb”?

Yes, we heard that right. During the annual CES tech conference in Las Vegas last week, Delta’s chief executive, Ed Bastian, unveiled a billion-dollar plan to bring free Wi-Fi to all SkyMiles members, in partnership with T-Mobile and Viasat, and to replace “dumb” seatback screens with “smart” ones.

They’re calling the new platform Delta Sync, and it’s slated to launch this spring.

“We want to make travel more personal,” Bastian said from the C Space keynote stage inside the Aria Resort and Casino. “When you think about personalization and your relationship with a brand, that’s the next frontier of travel.”

Personalization is the dominant digital strategy across the entire travel and hospitality industry these days, as it strives to recover from the pandemic. And Delta is literally throwing a billion dollars at it. The idea behind the airline’s new customer experience (CX) platform is to make it as familiar as possible, while making your in-flight entertainment experience akin to using your smart TV at home — which means building a new interface with new functionality.

According to the airline, features will include curated content recommendations, real-time seatback notifications with connecting flight and baggage claim information, SkyMiles status recognition (here’s looking at you, newly minted Medallion member), and the ability to save content on a list for your next flight. If you didn’t finish that movie, you’ll be able to pick up where you left off.

Photo Credit: Delta Air Lines

What Passengers Watch

Even at 40,000 feet, content is king. To decide which content to offer, Delta has been using its own big data to decipher passenger preferences.

They’ve been at this since 2008, when Delta initially launched Gogo in-flight internet service on board six aircraft. The service wasn’t free, and more often than not, it didn’t work. Today, Delta is phasing out its partnership with Gogo — but it’s walking away with more than a decade of consumer behavior data.

“When you look back, that first-generation Wi-Fi isn’t as good as it is today; but when we had it, we saw the behavior of what customers were doing. Even though they weren’t smart screens, we see how people interact with the content on them, and what they’re logging in to,” Ranjan Goswami, SVP of customer experience design for Delta.

Essentially, Goswami and his 160-person team, whose job it is to design and iterate the end-to-end digital experience for the airline both on the ground and in the air, have been using data from Delta’s own 150,000 seatback screens to build Delta Sync. In an interview with Huge Moves, Goswami shared their key findings:

People want to be digitally engaged on board the airplane

They are using multiple screens, just like they do on the ground

This is an opportunity to personalize the screens on board to mimic what customers are used to on the ground

“We took a bet that this screen that we provide is table stakes; you can’t do business without it. The customer expects it, because that’s what they have at home. Screens everywhere has been part of our product spec for a long time,” Goswami added.

Offering customers free Wi-Fi is the first step, which Delta will launch February 1. Building solid content partnerships is the next.

Delta CEO Ed Bastian joins MediaLink CEO Michael Kassan on stage January 5 in Las Vegas at CES 2023. Photo Credit: Delta Air Lines

The Partnership Playbook

With the launch of the Delta Sync Exclusives hub this spring, SkyMiles members can access free content that is typically behind a subscription-based paywall, including Paramount+ entertainment, New York Times Games, Atlas Obscura travel content and Resy, a restaurant guide website and reservations app owned by American Express.

This strategy is expected to bring many more Delta passengers into the membership fold. Bastian disclosed that “roughly half” of the customers traveling on Delta today are registered in their SkyMiles membership program. But about half are not. “There’s somewhere in the 20 to 30 million range of people who travel on Delta who are not members that we look to eventually enroll in the program,” he added.

Similar moves have worked well for Delta. When it launched a loyalty partnership with Starbucks in October last year, for example, the carrier quickly picked up more than a million new SkyMiles members. The only way to earn Delta miles via Starbucks is to be a SkyMiles member. The same tactic is being deployed for the upcoming free Wi-Fi rollout in February.

As Bastian said during his CES keynote: “We’ve invested a billion dollars to do this. The only requirement is that you log in via your SkyMiles account.”

As the saying goes, there is no such thing as a free lunch. If the product is free, you’re the product. This strategy speaks to just how lucrative loyalty programs are for the biggest airlines, all vying for the same coveted customer: the frequent flyer.

One of the best ways airlines have found to attract and retain frequent flyers is with a co-branded credit card. Most carriers have long-term contracts with credit card companies, which purchase miles from the airline and offer those miles as rewards for spending.

The business logic behind this strategy is that loyalty members tend to stick with their airline, and to gain ever higher status, they’ll often pay more for a ticket on their own carrier (even if Expedia displays a lower price). That means airlines can count on recurring revenues from loyalty members that are not only stable, but higher.

American Express is perhaps the most important brand partner for Delta airlines to date. According to Delta’s latest quarterly report, the company reported “record” American Express remuneration, supporting a higher full-year outlook. From Amex, Delta is expected to have earned $5.5 billion in 2022.

In 2023, Bastian expects this to go even higher: “Our plan with Amex for this year in 2023 is $6.5 billion. In 2024, we’re aiming to get to $7 billion. Those are the numbers that both we and Amex are in agreement on. Candidly, I think this [free Wi-Fi launch] is going to enable us to get there maybe even faster.”

A Two-Way Street

To get brand partners like the New York Times and Paramount to lift their paywalls, you need to offer them something of value.

“Marketers are constantly fighting for the attention of the consumer. Here you are five miles above the earth. This is a captive audience, and we’re curating for that audience on an individual level things that we believe are relevant to them,” Goswami said on Delta’s shuttle flight to Las Vegas for the CES conference. “That is the value for partners — being able to discover ultimately makes you want to become a subscriber.”

For everyone involved, a strong Wi-Fi signal in flight is the key to the success of the new Delta Sync platform. If it works, and Viasat’s promise of high-capacity bandwidth pays off, Delta will have the first-mover advantage among the largest U.S. carriers. Though free Wi-Fi in itself is nothing new — JetBlue began offering it on its relatively smaller fleet in 2017 — the scope and scale of the CES announcement marks a major milestone in Delta’s quest for connectivity, including its vision to bring a personalized smart TV experience to our seatback screens.

It took only 10-plus years of user data, a dedicated design team, a billion dollars and a few high-capacity satellites hurtling through space — no big deal.