F3

Travel

December 7, 2022

Back in Business

As travel demand roars back, outpacing supply around the globe, premium seats remain a critical profit driver in commercial aviation. Here, an inside look at the battle for business class.

Words by Jennifer Leigh Parker

Photos courtesy Sean Pressley

This is a David and Goliath story. It’s about the little guys punching above their weight, stealing market share from the big legacy carriers — but Goliath isn’t giving ground willingly.

First, you need to meet Eric and David Zipkin, two brothers who are markedly modest in the flashy business of private aviation. Back in 2001, they co-founded Tradewind Aviation with just one plane, an eight-seat Cessna Caravan turboprop. As David recalls: “I remember the day we picked up the Cessna in Maine, sat on the plane and kinda looked at each other and said, ‘Now what?’”

Since launching, they’ve never done a roadshow to attract investors, and they’ve never tapped the capital markets. “We never wanted the debt, and we didn’t want to grow beyond our britches,” adds David, at ease in a gunmetal-gray designer suit that matches his chief-marketing-officer polish. His comments come amid a field of overleveraged airlines with investors to answer to on a quarterly basis. Often, the result is overextending flight capacity and underdelivering on service. The fact that Tradewind is self-financed takes some of that pressure off.

David has to raise his voice to be heard above jet engines taking off from the busy private wing of New York’s Westchester airport called Million Air. It’s a gauche name for a fixed-base operator (FBO), known in the industry as glorified gas stations, but this particular location, which features a golf simulator and ski-lodge-style lounge, was built by the Texas-based family behind the Mary Kay makeup empire to service a wealthy clientele. As Eric quips, “The more fuel you take, the more welcome you are.”

Today, Tradewind operates private charters to more than 100 regional destinations, plus scheduled shuttle service throughout the Northeast and Caribbean with just 23 planes. Twenty new Pilatus PC-12 aircraft are ordered and on the way, at a list price of roughly $6 million each. It took until now to grow like gangbusters.

“We were deeply in the red for four months during COVID. Everyone was. Fortunately the business came back very strong,” adds David.

When asked whether they’re taking market share from legacy carriers, their answer is yes. Eric, the president of Tradewind, even quantifies it: “Ultimately an 18% reduction in capacity on the legacy side is very close to an 18% increase in demand for us, because for every airplane, a certain percentage of those travelers are potential customers of ours.

Eric Zipkin, president, and his brother, David Zipkin, co-founder and chief marketing officer of Tradewind Aviation at the Million Air FBO in Westchester, New York. Photo by Sean Pressley

Tradewind’s Pilatus PC-12 airplane at the Million Air White Plains terminal in New York. Photo by Sean Pressley

The Trillion Dollar Question

To be clear, there isn’t a solid consensus on exactly when corporate travel will return to its former glory days, if ever. Some sectors need to pound the pavement and see customers, while others can operate virtually. But the data is bullish. Most industry forecasts show corporate travel ramping back up within two to four years, including the Global Business Travel Association (GBTA): “The global business travel industry continues its progress towards full recovery to 2019 pre-pandemic spending levels of USD $1.4 trillion.”

The question is: Who gets that money? It’s been a turf war ever since U.S. airlines accepted more than $50 billion in federal aid, and two years later still managed to anger hordes of passengers during the summer of 2022 hellscape of lost luggage, canceled flights, staff shortages and mass delays in what seemed like every traveler’s worst nightmare. Amazingly, all this customer dissatisfaction has not put a dent in demand. In 2021, U.S. airlines generated more than $193 billion in operating revenue, up from $131 billion the year before, according to the latest data from Statista.

This scenario is playing right into the hands of the airlines that can offer a better experience. So it’s no surprise that on this rainy day in September, the hangar outside the Million Air lounge is crowded.

Photography Unsplash

Come Fly With Me

In the private and semiprivate category, the leading players (NetJets, Wheels Up, XO, Aero, Tradewind and others) are hustling to increase capacity and targeting C-suite clients in this brave new world of “bleisure” travel. They’re capitalizing on a marked shift in consumer-spending behaviors.

This segment aims to take the pain points out of flying, mainly by offering significant time savings and streamlined check-in processes. In many cases, you can simply drive up to the airplane 20 minutes before takeoff, show your ID and board. Hello, Mr. Bond.

The hassle (and viral risk) of large crowds is also completely removed from the equation, because private carriers aren’t flying wide-body jumbo jets. Their planes typically carry from six to 20 passengers, which means that they are cleared to take off and land at smaller regional airports, with shorter runways. A Boeing 757 can’t do that.

Pricing, too, is more accessible now than many realize. “With our turboprops, eight people sharing the flight is really not much more expensive and is actually sometimes cheaper than going business class on an airliner,” adds David.

One-way seats on Tradewind’s 11 scheduled routes throughout the Northeast and the Caribbean range from $320 to $895, depending on dates and destinations. And no membership fee is required. Comparatively, a one-off initiation fee at Wheels Up is $2,995 in addition to hourly flight rates. Wheels Up membership is required and buys you 12 months of air time.

But there’s a catch. This level of affordability inevitably means more flight traffic, which comes at an environmental cost. The airline industry’s emissions track record is dismal. Experts say commercial air travel — all air travel is commercial, if money changes hands — accounts for about 3% to 4% of total U.S. greenhouse-gas emissions. And the United Nations expects airplane emissions of carbon dioxide to “triple by 2050.”

Though nearly every new plane model touts greater energy efficiency, progress comes in fits and starts. For example, in March, NetJets secured the right to purchase up to 150 electric vertical takeoff and landing (eVTOL) jets. In September, United Airlines announced a $15 million agreement to buy 200 electric air taxis from Eve Air Mobility, with the option to purchase 200 more. For the time being, these ventures remain grounded because the Federal Aviation Administration (FAA) has yet to certify electric planes as safe for commercial use.

Airlines can’t independently control their electric outcomes, which begs another question: What about the travel experience can they actually control?

“The legacy carriers have very little that they can control,” says Eric. “It’s really just the seat and your ego in many ways. That’s it. By virtue of sitting up front, you’re not stripping away the inconveniences that you share with the back, which is the long boarding process, the hassle of getting to the airport early and everything else…. We control everything but the weather.”

It’s a hyperbolic statement, but the battle for business travelers shows that the more the experience can be controlled, the more market share can be won... But of course, you can’t win without pilots.

The Pilot Shortage

The labor shortage facing the aviation industry has been nothing short of a crisis since the pandemic sent thousands of pilots, considered front-line workers, into furlough or early retirement. Now, the whole industry is scrambling to get them back.

For their part, the Tradewind brothers are paying 30% more for pilots now than they did before the pandemic. “We need to attract more people to become pilots, and we need to train those people. You’re going to see more airlines working to break down the financial barriers to becoming a pilot,” adds Eric. He mentions the United Airlines Aviate program, which aims to hire more than 10,000 pilots in the next decade, according to its website. JetBlue also launched JetBlue Gateways, which partners with Aviation Accreditation Board International (AABI) accredited colleges and universities to offer multiple trajectories for pilots in training. “Those programs are at the leading edge right now.”

Tradewind is one of the partners in the JetBlue Gateways program, actively engaging in the training and hiring of new pilots.

Business-Class Only

In the long-haul category, another small but mighty operator is quietly stealing market share from bigger players. It’s called La Compagnie, a French boutique airline that took its first flight in 2014, and since then has achieved what many have tried and failed to do — operating “business class only” service with a competitive cost structure.

La Compagnie’s round-trip flights from Newark airport to Paris, Nice and a new route to Milan cost around $2,400, which, on average, is about 20% to 25% less than business-class seats on legacy competitors like Delta, Air France and United. (Prices on La Compagnie used to be even lower, but rising fuel costs now translate into higher ticket prices across the industry.)

These flights include lie-flat seats, “bistronomic cuisine” (Franglais for a four-course meal, complete with wine and dessert), high-speed Wi-Fi and a fresh white pillow and blue blanket that no one will charge you extra for using.

According to La Compagnie president Christian Vernet, the business has returned to profitability. Mainly that is thanks to cost savings on jet fuel, due to the efficiency of its two new narrow-body aircraft, the A321neo. Jet fuel is typically the largest variable operating cost for an airline — more expensive than maintenance or crew, according to the FAA. “The fuel burn on a typical New York to Paris flight is about 30% less that the one we had in the past when we flew the Boeing 757s. That’s a significant difference in variable costs,” says Vernet. Currently, the airline operates all flights with only two Airbus airplanes, though Vernet says his plan is to ramp up: “We want to increase to 10 airplanes, four to six years from now.”

He’ll need robust revenue to do that, and so far this year, revenue has been increasing. La Compagnie’s sales in 2022 were 20% higher than the same time period in 2019, pre-COVID. Its average load factor — the percentage of filled seats on its fleet during a particular time — hit a high of 83% during the summer months. Because a better experience sells seats.

Bienvenue à bord de l’A321neo. It’s a sleek, narrow-body aircraft with only 76 business-class seats, cast in powder blue and bright white. The cabin vibe is calm, even zen, as if you’re in a spa about to get a facial. (The ambient temperature and lighting are subtly adjusted throughout the flight to support rest before landing in a new time zone.)

The in-flight promo video calls this “the plane to be” before running the most relaxing safety briefing ever, which entails two attractive people in white spandex performing yoga poses while explaining how to use an oxygen mask. You’re offered real Piper-Heidsieck Brut Champagne, not prosecco (which some business-class cabins, which shall remain nameless, get away with). Then suddenly you’re in the clouds, cocooned in a pink and purple sky, with all those New York dramas behind you. As if on cue, the lighting dims and you’re invited to put up your feet, watch a curated collection of indie French movies, or listen to a guided meditation from Petit BamBou, the Francophile’s answer to Headspace. At touchdown, you’re delivered to Paris via Orly airport, avoiding the behemoth that is Charles de Gaulle.

To be fair, small airlines like La Compagnie aren’t trying to service the masses, and therefore they can offer a very different product compared with legacy carriers. The difference is that the big carriers try to serve all markets, often within the same aircraft, by segmenting passengers into economy, premium-economy, business and first classes.

As Vernet sees it, “We have long-haul airlines that offer very low fares for no-frills service. And the major airlines have to fight against that on a daily basis. This is significantly impacting the revenue they generate from the back end of the plane. So they need to pay attention to the revenues generated from the front end, from the business-class seats.”

They’re not going to give up on selling the premium seats without a fight — because they can’t.

Courtesy Delta Air Lines

Courtesy Delta Air Lines

Legacy Carriers Fight Back

If this were a cinematic David and Goliath story, this would be the bottom of the second-act climax. Just when you think David might have a chance — a titan named Ryan Marzullo calls in the infantry. Four billion dollars’ worth of infantry, to be exact.

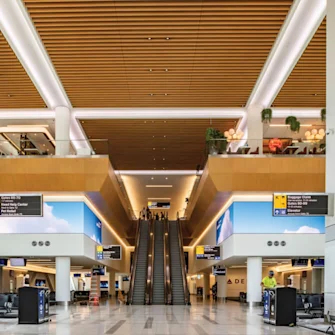

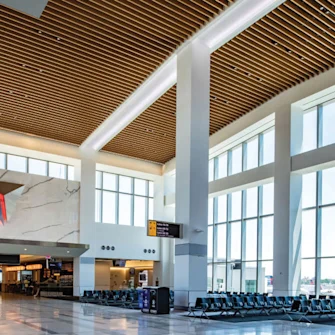

Marzullo is the managing director at Delta overseeing the design and construction of its gleaming new $4 billion Terminal C at LaGuardia Airport, which opened in June. It’s just one part of the Port Authority’s ambitious $25 billion plan to revamp all three of New York’s major airports.

As we walk through this 1.3-million-square-foot, 37-gate terminal, Marzullo shares details of Delta’s objectives: “Notorious as it was for poor service, LaGuardia had a compact, quick, in-and-out appeal because of its proximity to Manhattan. And we wanted to maintain that for our business customers. We designed this new terminal for speed and efficiency,” he says, striding through the space wrapped in 25-foot floor-to-ceiling electrochromic glass (smart glass that tints to reduce glare) like he owns it. Because, in a sense, he does.

Speed and efficiency in a place like this requires advanced technology. So Delta contracted a cloud-based automation-software company called Iconics, which specializes in the management of large-scale transportation and shipping facilities. It’s an overarching platform, gathering real-time, encrypted data on the entire terminal’s mechanical systems, optimizing the performance of heating and cooling and flagging problems before or as they occur, so staffers can respond quickly. To give you a sense of the level of IoT tech involved, Microsoft and Google also partnered with Iconics to monitor their campuses. “This is probably one of the most advanced terminals in the country because of the systems we’ve implemented here,” says Marzullo.

This is, without question, a major upgrade to the disgrace that was LaGuardia (frequently ranked as one of the worst airports in the country). The trip through security and to the gate is clean, spacious and clearly marked with digital signage. By year-end, OTG, the company that operates LaGuardia’s food services, is expected to launch a new app enabling travelers to place an order from their phones and pick it up on the go. If you want a latte delivered to your gate, for example, that’s going to be possible.

“The global business travel industry continues its progress towards full recovery to 2019 pre-pandemic spending levels of USD $1.4 trillion.”

Global Business Travel Association (GBTA)

But the massive price tag on this terminal doesn’t equate to a better business-class flight. Even the lounge can’t change that. The new Delta Sky Club at Terminal C, which Marzullo calls the “flagship” lounge, seats nearly 600 guests over a sprawling 31,000 square feet. (It will comprise 35,000 square feet once the outdoor Sky Deck expansion is opened in 2024.) It’s the opposite of exclusive.

During our tour, the large but very crowded Sky Club looked like a cafeteria, with two food buffets, lounge-area charging stations and nice views. It’s a noticeable gaffe that major carriers are making, covered recently in “The Democratization of Airport Lounges” by the New York Times. This trend certainly doesn’t suggest the return to a golden age of travel that the Frank Sinatra music piping through this concourse tries, but fails, to capture.

There are hard economic reasons to go high-volume on these clubs, mainly to do with the fact that New York real estate is very expensive, and Delta is the general contractor with a budget to manage. Government funds didn’t build this terminal and won’t save Delta from return-rabid investors. (As previously reported, Andrew M. Cuomo, then New York’s governor, persuaded Delta Air Lines to spend as much as $4 billion on Terminal C.) The economics required to build an “ultra premium club” for Delta One first-class passengers work better over at John F. Kennedy International Airport, given the higher spend expected from transcontinental passengers. This first-class club is expected to open in early 2024. Marzullo adds: “That’s for our transatlantic customers…. When it opens, it will be a very big deal.”

To its credit, ever since Ed Bastian came on board as CEO, Delta has been considered the most tech-savvy airline in America by industry insiders. It was, for instance, the first carrier to roll out fully operational facial-recognition technology in Atlanta and Detroit, enabling Delta SkyMiles members to scan their face at bag drop and boarding instead of using a physical passport.

Courtesy Delta Air Lines

If You Can’t Beat ’Em, Join ’Em

Delta is also the carrier partnering with Wheels Up in a move to attract high-net-worth clients. The partnership is a joint-loyalty program, in which Wheels Up members will be eligible to accrue miles in Delta’s SkyMiles loyalty program and earn status upgrades, among other perks. “Together, Wheels Up and Delta will democratize the industry to make private flying and the private flying lifestyle accessible to significantly more individuals and businesses around the world,” said Wheels Up founder and CEO Kenny Dichter in a press release.

Ironically, Dichter’s rarefied product isn’t based on democratic principles at all. Business class is still expected to be a premium product in the eyes of consumers, and the revenue we’re seeing flow into private carriers reflects that. With this much competition in the market, you can’t really fake it.

In the battle for business, the victors will be those that can offer not just a better seat, but a better experience.